Another reason to look forward to Zevvle!

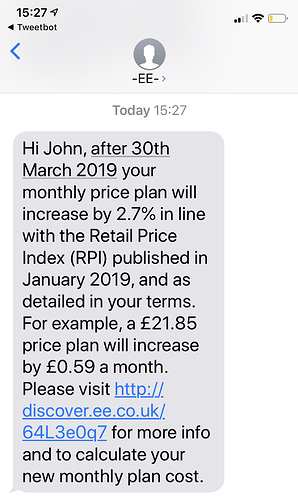

There’s so much wrong with this it hurts my eyes.

First of why is their sender name with dashes? I’d expect to see this on kids’ usernames on gaming platforms, not a reputable (well that’s what they’re trying to be at least  ) carrier. It is also inconsistent, other texts from them will be without the dashes, and so on…

) carrier. It is also inconsistent, other texts from them will be without the dashes, and so on…

Also why provide an example? The system already has access to your name, why can’t it also access your price plan and give you real numbers? Why is it up to you to calculate this?

Also the HTTP (not HTTPS, so just what you wanted for insecure public Wi-Fi) link to a redirect/link stalking service is the cherry on top. Is it too hard to link directly to https://ee.co.uk/pricing or whatever? That link also goes to a third-party, so it’s safe to say those guys don’t even have the infrastructure to send such notifications directly and are outsourcing to a third-party (the same that powers multiple SMS spam campaigns btw).

Finally I’m not impressed by them having to do this at all. Not only do I think it’s not worth it (the customer confusion and thus support overhead, bad user experience and overall negative feeling it induces - nobody likes paying more) but also, are they that desperate? 2.7% is peanuts, can’t they just cover it and leave existing customers as-is (plus, it then becomes a perk for staying longer with them, as new customers will pay the new prices while existing customers keep the original pricing).

Speaking of bad experiences I’ve had one with a popular cable (“fibre” as they call it) provider in the UK with red branding.

I called to cancel and after the automated “retentions” BS (the phone IVR offered me a few quid discount in exchange of a new 12 months contract… laughable), they agreed to disconnect it in 30 days (as per the contract) - to their credit, the advisor was very good with it and didn’t try to push further once I told them I needed more than 20Mbps of upload).

The problem is that apparently it was cancelled immediately… which is great when the new leased line will take around 30 days to install… so I call back the next day and after 20 minutes on hold they claim they cancelled the original disconnection and scheduled a new one for 30 days (they were also surprised how the first one was immediate).

The connection came back the same day but I’m still expecting more nasty surprises (either the new scheduled disconnection won’t happen, and the next one will conveniently take 30 days this time, after I’ve already got the new internet installed and have no use for that one), or they’ve silently subscribed me to a new 12-month contract just to get the connection working again.

Speaking of broadband providers, we recently canceled our contract with one. I made the request about a month in advance, giving the day on which it should be canceled.

This went through fine, apart from the web interface now refuses to show any information with the handy message “This account was closed on [cancellation date that’s in the future]”.

The aforementioned provider’s website is throwing all kinds of errors on my account not for some reason. Who thought that an account in scheduled cancellation would be such an edge case?

Don’t you mean the present?

Well direct debits are still a thing (despite being inferior to cards on every front) so clearly at least some people still don’t think cards are the present.

No, for consumers it’s even better then cards as chargebacks are long and complicated. The direct debit guarantee is excellent and easy to action.

Agreed about the guarantee, but that’s about it - I don’t see any other advantage of DDs vs cards. Also the direct debit guarantee is a bit of a double-edged sword as it can be abused (where as card disputes have some sort of “sanity check” applied to them by the card network). While I couldn’t care less about most companies who use DDs (most of them are scum in one way or another, and if you don’t think so it’s just a matter of time before you start agreeing with this), it could be a significant risk to a small business.

You seem to be coming from a business perspective while I’m coming from a consumer perspective. I’ve never used the DD guarantee even when a company has claimed a DD early or late as I will still have to pay the amount outstanding in the end. The potential damage to my credit score is not worth it.

In saying that if everybody thought like myself then the guarantee isn’t worth the paper it’s written on.

I’m not taking either side, just trying to find the right balance. I feel like the credit card disputes are the right balance where the consumer has options in case something goes wrong but there’s still oversight, where as DDs can be claimed back without any justification (risk-wise you might as well not take payments and just have the customer promise they’ll pay you eventually), which is IMO too big of a liability for a small business that’s just starting out (especially in a field where there are high incentives for fraud - making spam calls - and low chances of being caught, since the service is not tied to an address).

I have personally used the DD guarantee once however the reason I did so would’ve also won a dispute no questions asked (essentially was double-charged, paid my credit card via FPS but their legacy rust still took the DD a few days later).

First of all it’s two different things. 1st of all it’s not your money it’s the credit card providers money so they can take all the sweet time in the world to do checks. 2nd On the other hand it’s the money belonging to an individual so yes I would want my money back right away in that situation and rightly so.

As you said risk wise I don’t think that’s a big deal because like I’ve said above, you would still owe the business the balance in the above case. Any tool can be used for bad as well as good purposes. In any case I do think there is a place for DD, for a new business I’m not sure but I guess it all depends on the risk model of the above business.

Let’s keep some context and sanity. Most companies using DDMs are not “scum”.

GoCardless has been innovating use of DDMs for small businesses in recent years.

They still have a place. Are they an anachronism? I don’t know.

Hello @Rjevski

Direct Debits are actually incredibly useful. It allows a business to take money from your account based on your account number and sort code directly, as opposed to your card where you’d need to update your details every time you lose it. Makes it nice and simple to keep your bills in tact and is much appreciated by my mother who is busy a lot of the time and as such would probably forget to pay her bills.

Banks can use this to actually work out when you’re going to be paying your bill, so you don’t fall into arrears and end up with collections outside your door wanting your brand new car and £500+ in fees for the privilege of selling it, should you not cough up.

It’s good for consumers as well (see direct debit guarantee) as it doesn’t give the banks any wiggle room to decline the refund. This is good when you get an authorization held for hundreds of pounds by your mobile carrier (which a certain network has done to another member of the group of forums that we all seem to come from) and you need the money back that second because your rent is due tomorrow. With direct debit guarantee? Instant. Authorization clearing + chargeback or refund? A week. If a company believes it’s still owed the debt, that is for a county court to decide and for the debt to then be honored or collected.

Also helps keep your credit report looking nice and juicy assuming you keep up with you’re payments, which you just don’t get the option from with card (unless it’s a credit card, which you’d pay by: direct debit (although I don’t get why they can’t just charge your debit card with the balance at the due date))

May I also mention the direct debit guarantee means if your bank makes you incur late charges you can have a note added to your credit report to reflect that it was your banks fault (you might even be able to have them sweet talk the person your payment was missed on, as your bank is likely going to have a lot of customers in the same boat) and they have to cover the cost of said incurred fees (iirc)

Please don’t equate card payments to the future. Direct Debits are the future for bills. Card for everything else.

I tend to choose to pay by direct debit rather than by card whenever I get the chance, personally. I like that I can see all of my active direct debits via my bank and have the ability to cancel them there. Cutting out VISA or MasterCard just feels good too.

Banks can use this to actually work out when you’re going to be paying your bill

Are you referring to submitting the direct debit early for collection at a later date (which modern banks display)? If so I always found it unreliable and random. From an implementation point of view I don’t see why the merchant would bother submitting the DD request early (and keep track of, and have to cancel/amend it if the amount ends up changing in the meantime) instead of as late as possible (so there’s less things to worry about and it’s less likely the amount would change).

so you don’t fall into arrears and end up with collections outside your door wanting your brand new car and £500+ in fees for the privilege of selling it, should you not cough up.

Unless we live on a different planet, creditors can (and do) give you plenty of time to get the situation resolved before collections or a hit on your credit report are actually involved.

It’s good for consumers as well (see direct debit guarantee) as it doesn’t give the banks any wiggle room to decline the refund

True but it’s also a double-edged sword and puts a bigger burden on the business to manage that risk.

This is good when you get an authorization held for hundreds of pounds by your mobile carrier

Authorizations can be cancelled by any decent bank. Monzo even offers it in-app.

Also helps keep your credit report looking nice and juicy assuming you keep up with you’re payments

My credit report seems fine from both Virgin Media and my credit card company despite cancelling their DDs and paying by card or bank transfer, so the two aren’t linked and aren’t mutually exclusive (you can very well have companies report to CRAs even if you pay them by card, although personally I want CRAs to die in hell so I won’t miss them if they aren’t involved).

Please don’t equate card payments to the future. Direct Debits are the future for bills. Card for everything else.

One option allows me instant notifications & instant approval/decline for the merchant, works worldwide & across currencies. The other is UK only, takes 3 days (at best) for the merchant to actually collect the money and exposes them to huge risk (that they try to mitigate with toxic entities like CRAs).

Maybe we just have a different definition of “future” but I’ll take cards any day.

If they change a date they’re required to inform you, so it should be pretty reliable.

On top of that it’s processed by the company behind BACS so they should have advance warning (it takes 3 days to claim iirc?)

Once it’s late it’s late. Granted one of the people I’m with haven’t marked any of my payments of late despite me forgetting to do it for a day or two sometimes.

They definitely don’t give you a lot of time for a hit on your credit report though

Collect money from client with debt collection agency. Agency charge customer.

Wrong.

Any decent bank won’t cancel an authorization because it means you see the wrong amount when the merchant claims the money, which they have every right to.

I know Starling wouldn’t cancel my authorization from Uber without a screenshot from the support saying they had no intention of claiming on it. (It was food they’d never sent me)

Good luck getting credit from someone who isn’t your bank if CRA’s die.

geoblocking via BIN

Just like they can inform me when they’re about to take a card payment? Your point was that the bank itself knows about it and can tell you - if we’re now relying on the payee informing you then the point becomes moot.

Is this just FUD or do you have actual evidence for this? Because I have evidence of the opposite, multiple missed payments that were resolved within a week or so and no problems at all.

So we’re introducing even more middlemen, especially from an industry that is known to be shady? Why not just you know, have a system where money collected is actually collected (minus exceptional circumstances) instead of relying on shady people to solve a problem you’ve created in the first place?

So provide a screenshot? Seems like Starling did everything right, they’re happy to cancel an authorization if the merchant has no intention of claiming it?

CRAs aren’t a thing in France and the lending industry is just as healthy as here, if not better.

You’re describing an intentional block the merchant would have to implement while I’m describing an inherent limitation of the Direct Debit system. Cards work worldwide unless made not to (by explicitly implementing a BIN blacklist/whitelist), Direct Debits don’t work worldwide no matter how hard you try because your customers need an UK account (and I assume you’d have a hard time taking direct debits without a legal presence in the UK too).

My point is either way you will have knowledge of when the debit to your account is coming.

FUD?

I know my mother’s credit report nearly got hit because Nationwide’s cash machine broke while she was paying in, she explained it to our landlord though and he gave a pass until Nationwide paid the cash to the guy in the meantime (they did this out of courtesy while they sorted the issue).

I don’t think it’s shady at all. Pay your debts or someone repossesses your assets. Pretty simple.

My mother had the a similar issue (Uber had double charged her) and couldn’t get in touch with Uber for days when she needed that money the next day.

Starling didn’t release the authorization.

If Uber took it through direct debit she could have reclaimed the money instantly. Chargeback would have taken 8 weeks and Uber eventually told her to wait 7 days for the authorization hold to run out (at which point Starling did clear it, but too late.)

How so? Do the banks provide information to each other on account health before giving credit? How do things like American Express and Diner’s Club function without being able to see you have a history of repaying your debts?

Fwiw Transferwise will be introducing DD’s at some point.

I get your point though, I’ll cede on this, card is much better for acceptance although some merchants like Apple are losers when it comes to GeoBlocking

True, that could be a perk, but even then only very recently did the new banks actually start displaying upcoming DDs. Before that people managed just fine having a single day every month where their payment would go out and card payments can work the same way. Cards also have the advantage that payments can be retried instantly, so a creditor can send you an email saying it failed and you can resolve the situation immediately without incurring any charges.

So that’s exactly what I’m saying - a missed payment isn’t a big deal as long as you do your best to resolve it. In this case cards or DD’s wouldn’t change much - either you have the money and you resolve the situation promptly and everything’s fine or you don’t and then you’re out of luck but DDs wouldn’t magically give you money you don’t have either (on the other hand some banks still charge for declined DDs while card declines have always been free).

I don’t think I’ve ever advocated for not paying your debts? But 1) collections don’t come to your door the same day as a payment declines and 2) I’d prefer a payment system where collections just don’t have to exist at all because the system guarantees the merchant got their money. Same reason shops would rather dissuade theft to begin with rather than dealing with it after the fact.

Applying for credit means bringing proof of income and potentially bank statements and the lender then makes their decision based on that. This means not only is identity theft harder (you can’t get credit in someone’s name with just a name, address and fake ID) but nasty companies can’t just ruin your credit arbitrarily. There is still a register of bad payers but lenders have to take you through court to actually be put on there (and it’s limited to actual lenders, not utilities).