Anything useful here for Zevvle? I’m thinking the payment you take when the amount on my account drops below £5.

Maybe for reducing fees, but the other benefits (e.g. speed) we get from card payments… compared to direct debits I can see the appeal!

I’ve seen more and more of these “Open Banking” payment solutions come up and they’re pretty worrying regarding privacy. Most of the “security” is based on trust and not granular access; as far as I know there’s nothing technically preventing the third-party from accessing your transaction history even if all they actually needed was only to submit a Faster Payment. FreeTrade had something like this (via TrueLayer) and required full access to my Starling account when I tried it (presumably because the open banking APIs don’t allow anything more granular) so I obviously noped right out of there.

The login experience for legacy banks also sucks and is much more painful than entering a card number (which password managers can handle), and when things go wrong the service provider would typically get a support query while having no visibility into the process (as it all happens on the bank’s website - so if the flow fails there or a stupid cookie banner obstructs the login form like on Barclays’ - you can’t do anything and there is no concept of “test” bank accounts to be able to test every bank’s flow yourself).

Under the hood it’s just a Faster Payment, so it’s trivial to provide the customer bank details and a reference (unique per account) and then receive these payments into a modern bank which gives you instant webhooks - and the customer would most likely be more comfortable doing something that makes sense and that they’ve done before (they’re making a bank transfer because they’re trying to pay a bill) rather than authorizing persistent access which is something they most likely wouldn’t have seen before. Andrews & Arnold does this successfully to take “deposits” for certain orders. But then again there’s no VC money to be taken nor customer data to be harvested so that’s why companies would rather push the Open Banking-based “solution”.

Looking at GoCardless’ article:

As part of our Early Access programme, Broadband provider […] is already seeing real results with Instant Bank Pay. […] is using the feature to collect one-off payments from customers where a payment has failed.

During this pilot, two-thirds of customers who experienced a failed payment were able to benefit from using Instant Bank Pay. Of those, 86% were able to make a successful payment within 48 hours, minimising disruption to their service.

This doesn’t sound impressive at all? They should’ve A/B tested this with cards (or just offered both options and seen which one customers prefer). But then again a company smart enough to do this probably wouldn’t be in that case study to begin with?  (sarcasm - most likely they get a rebate on their Direct Debit processing fees by test-driving this product, but I personally don’t think it’s a good idea).

(sarcasm - most likely they get a rebate on their Direct Debit processing fees by test-driving this product, but I personally don’t think it’s a good idea).

I like the idea of more direct bank-to-bank payments. Having an intermediary like GoCardless as part of that is ~the opposite of why I want it though.

Seems to me like the problem to be solved is the end user experience of making (and requesting?) transactions via Faster Payments.

As a customer, a credit/debit card payment suits me and I always choose that when given the choice. I would rather the transaction fees for card payments were regulated and capped than many of the kludges that are coming up as replacements.

Maybe I’m more tired than I think, but why can’t Zevvle accept faster payments?

One of the most common problems with faster payments is getting people to use the right reference so that the incoming payments can be matched to the right account. Do it can become a maintenance cost dealing with the errors.

This is 99% of the reason Open Banking exists yknow

I’ll be putting GoCardless to use in the near future, which will be neat; will Lyk how things go

Don’t really see the point of paying anything more as PAYG though if you serve non-UK clients (this is somewhat off-topic) as they can’t put your name on the bank statement outside of your domestic market

It does?  Have any uses actually come out of Open Banking yet? I was kinda excited when it launched but haven’t heard anything interesting since.

Have any uses actually come out of Open Banking yet? I was kinda excited when it launched but haven’t heard anything interesting since.

Officially (if you ask the FCA) AISP and PISP (Account Information / Payment Imitation) are separate things, but providers often have both certifications, so will just ask for the lot.

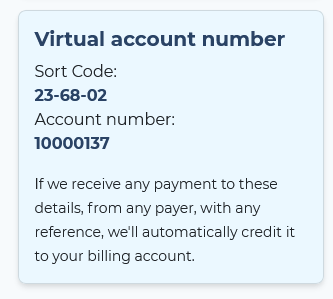

One thing Stripe has in the works (which I have access to) is virtual bank accounts. I can therefore generate new bank details per customer / per payment and never have to bother with what goes in the reference.

Not going to name my own company because I don’t want to be too self promotey here, but as an example when I login to the billing portal there’s this on the side of every billing account with a UK address.

That’s a good use, just no one. Is doing it

I think to start with I was imagining that individuals would be given API access to their accounts – which I would love. Ah well.